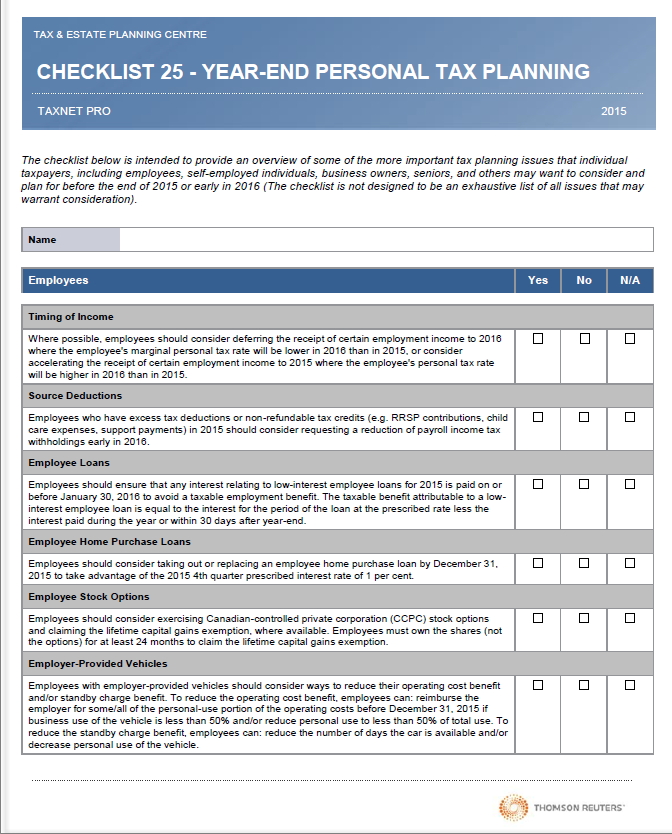

Year-end Personal Tax Planning Checklist

This checklist is intended to provide you with an overview of some of the more important tax planning issues that individual taxpayers, including employees, self-employed individuals, business owners, seniors, and others may want to consider and plan for before the end of 2016 or early in 2017.

An array of items covered in this complimentary checklist include GST/HST rebates, RRSP contributions, lifetime capital gains exemptions, remuneration accruals, succession planning, and much more.

Please fill out the brief form below to receive this checklist.